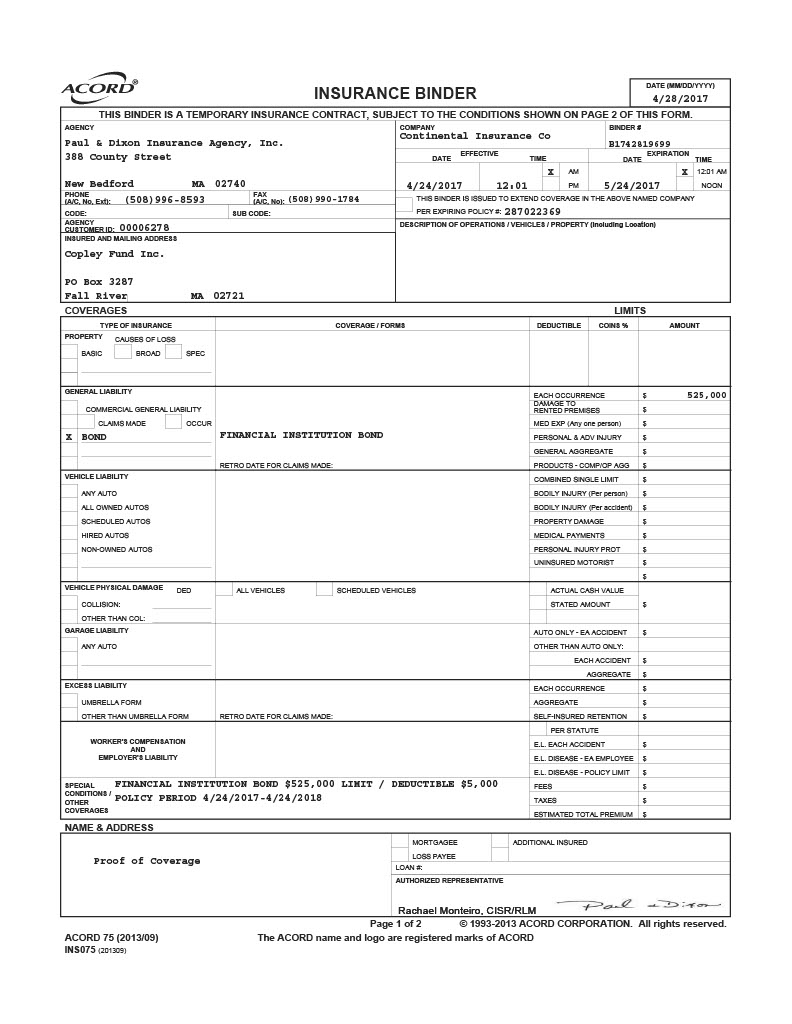

Description of your operations, vehicles or property to be covered.Ī binder is typically divided into sections, each applicable to a specific type of coverage, such as general liability or workers' compensation.Your agent's name, address and contact information.

A broker may issue a binder, but the document will not be valid until it is signed by an underwriter or other authorized representative of the insurer.Ī binder provides general information about your company, your insurer and your agent. Insurance brokers don't have binding authority because they don't serve as representatives of insurers. An agent can issue a binder only if they have been afforded binding authority (the authority to initiate coverage) by the insurer.

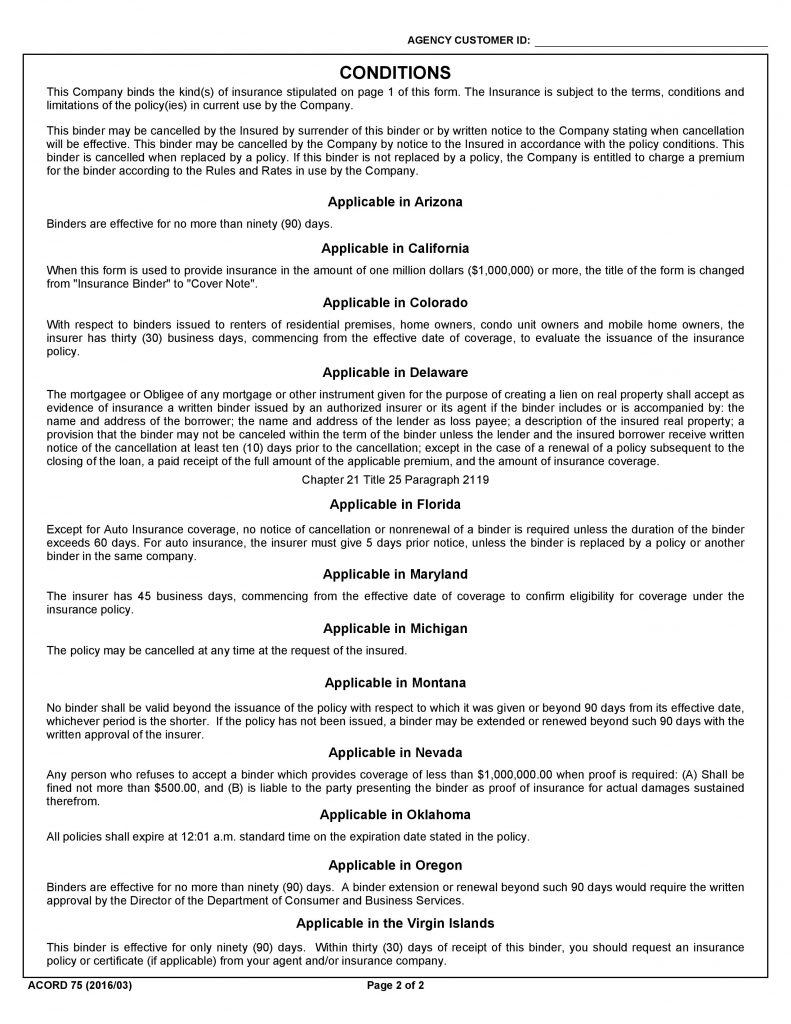

For example, if you are buying a new building and taking out a loan, the lender will often require you to insure the building against physical damage under a commercial property policy and will want to see the binder as proof of that coverage.Ī binder may be issued by an insurance company or by an insurance agent on the insurer's behalf. A binder dissolves once the policy is issued.īinders will often be required by lenders when a business takes out a loan. It remains in effect for a short time, typically 30 to 90 days.

It's called a binder because it "binds" your coverage and creates an insurance contract and is used temporarily until the policy is issued.Ī certificate of insurance is a form of proof of insurance warranting that you have coverage for a specific period.Īn insurance binder is a brief document that serves as a temporary insurance policy. When you have business insurance policies you will often hear talk of your insurance binder and your certificate of insurance, but do you know the difference?Ī binder is a contract of insurance. The Difference Between a Binder and a Certificate of Insurance

0 kommentar(er)

0 kommentar(er)